- ROI TEMPLATES EXCEL CAPITAL EQUIPMENT HOW TO ADJUST THE

- ROI TEMPLATES EXCEL CAPITAL EQUIPMENT SERIES OF CASH

- ROI TEMPLATES EXCEL CAPITAL EQUIPMENT DOWNLOAD THE ESSENTIAL

1 Postal Service policy 2. Capital projects that require an investment of at least 5 million are approved by the Postal Service’s Investment Review Committee (IRC). The higher the ROI, the better the value of the projected capital investment for the. Mail automation equipment, or vehicles.

It is up to the individual to make sure they understand what is being calculated. Some of the direct costs critical to an accurate cost benefit analysis template include: - capital equipment and durable goods costs, - tax and fee costs, - outsource or Although some explanations are provided in the Help worksheet and in cell comments, the spreadsheet does not define every term and every calculation in detail. ROI measures how much return you will receive on an investment relative to the cost of the investment.What to Include in a Cost Benefit Analysis Template Using the power of Microsoft Excel, you can include separate sheets for direct and indirect cost calculations, and feed them into an integrated cover sheet. It doesn't track cost basis and should not be used for tax purposes.Return on Investment is a performance measure that is used to evaluate how efficient an investment is, or for efficiency comparisons of numerous investments. It boils everything down to tracking only what you have invested and the current value of that investment.

Roi Templates Excel Capital Equipment Download The Essential

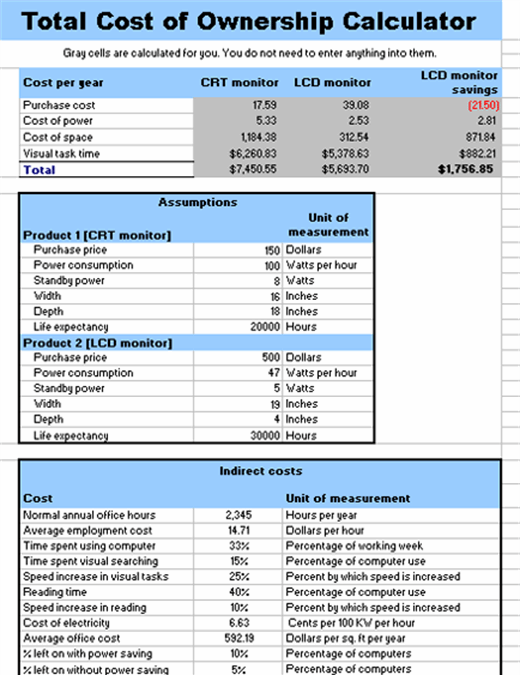

The spreadsheet and content on this page should not be used as financial advice. Download the essential Excel templates to perform a variety of ROI tasks, including content marketing metrics, website ROI analysis, healthcare quality initiative ROI, event ROI calculator, PLM ROI calculator, IT ROI, cost avoidance calculator, and TCO ROI.Disclaimer: This spreadsheet is NOT meant to be used for calculating anything to do with taxes. Equipment ROI.In this guide, you will learn about the role of ROI, its formula, why you would use it, the four methods to easily calculate it, and additional methods to break down work.

Reason #1 - A Consistent Way to Compare Different Types of InvestmentsHaving a consistent way to look at return on investment makes it possible to compare real estate investments to stock brokerage accounts or 401(k) accounts or simple savings accounts. Below are a few reasons why I use this spreadsheet to track investments. I'm not suggesting that it is the best way or that it should be used in place of reports generated by the advisor or financial institution. Choose a payback period formula, such as calculating internal rate of return or net present value, to make the best investment.I use a spreadsheet only as an ADDITIONAL way to track accounts. A capital expenditures plan is an important part of your operations plan.

Roi Templates Excel Capital Equipment Series Of Cash

Reason #2 - Learn how things workI like to try to understand how investments work, and that is why I like using a spreadsheet. However, the XIRR() function lets you take into account a series of cash flows - such as making additional monthly investments. For a one-time investment, this results in the same rate as the CAGR formula (see my CAGR Calculator page). In this spreadsheet, that is calculated using the XIRR() function.

This may be due to fees, re-invested dividends, or whatever. All these issues are important, but they can also be distracting when I am only trying to compare my out-of-pocket investment to the total value of the investment.Sometimes the information about what has come out of my pocket is lost when using only the online reports generated by a brokerage or financial institution. Reason #3 - Fees, Dividends, Interest Earned, Re-investments, Cost-Basis, Realized vs. I would not recommend using this investment tracker unless you are comfortable using Excel and can identify and fix errors that may be introduced.

Roi Templates Excel Capital Equipment How To Adjust The

Recording a Withdrawal from an AccountThe market value you enter will already take into account the withdrawal, so the question is how to adjust the Total Invested amount. For example, you might calculate a separate ROI value that includes the total income withdrawn from the account using a formula like ( Current Market Value + Total Income Withdrawn - Total Invested ) / Total Invested. You can use the blank columns to the right of the table to track whatever numbers you want (that's the great thing about using a spreadsheet). However, how do you handle investment income that you withdraw or that you have automatically deposited into another account?You may want to track the investment income separately and do your own calculation for return on investment. Handling Investment IncomeInvestment income that remains within your account as cash (or reinvested) will generally be included automatically in the total value of your account.

These formulas are fairly complex because they are array formulas that use nested IF functions (thanks to TonySaunders for this idea). In this case we are using it to calculate the annualized compounded rate of return.The spreadsheet also calculates a running XIRR value and a 6-period XIRR value (meaning the annualized rate of return based on the last 6 periods). XIRR Function for Calculating Annualized ReturnThis spreadsheet uses the XIRR() function to calculate the internal rate of return for a series of cash flows. This formula is not meant for official cost basis calculations, but it can be useful for basic investment tracking. This represents withdrawing a portion of the principal as well as a portion of the gain.

0 kommentar(er)

0 kommentar(er)